Economic troubles ahead but most don’t think it will be as bad as back then

We don’t see a crisis brewing in emerging Asia. But that is not to say there aren’t risks. We believe those risks are going to be mitigated and managed. Despite some portfolio outflows, we believe there is still sufficient liquidity in the market for some trading ideas

The weakening ringgit has caused anxiety. But is the economy in a similar situation to Malaysia’s worst ever crisis 16 years ago?

MANY Malaysians will still remember the Asian financial crisis of 1997/98. Nearly 20 years ago, the then crisis was responsible for the greatest capital market crash in the country and forced many structural changes we see today in the financial markets.

It was a time of great turmoil, with people losing their investments on a scale never seen since. Companies for years bankrolled on easy credit were leveraged to the hilt and crumbled under the weight of their debts as business evaporated and the cost of credit soared.

Shares traded on the stock exchange mirrored the scale of the troubles. The benchmark stock market index plunged from a high of 1,271 points in February 1997 to 262 on Sept 1, 1998. Words such as tailspin and panic were common in the financial section of newspapers and the chatter among market players as people scrambled to take action.

“More people are talking about it with the fall in the ringgit,” says a fund manager who experienced the difficult times in the late 1990s.

Triggering the crisis back then was the fall in the regional currencies, starting with the Thai baht. Speculators then zeroed in on other countries in Asia and Russia as the waves of attack on the currencies back then saw many central banks spending vast amount of foreign exchange reserves to defend their currencies.

Exhausting their reserves, those central banks requested for credit help from the International Monetary Fund to replenish their coffers.

Attacks on the ringgit and many other currencies in Asia sent the ringgit into freefall as the currency capitulated from a previously overvalued zone against the US dollar.

The ringgit dived into uncharted territory to around RM4.20 to the dollar before capital controls were imposed and the ringgit was pegged at RM3.80 to the dollar. The ensuing troubles were seen from the capital market to the property sector. Corporate Malaysia was swimming in red ink and huge drops in profit.

The shock from that period was different than what the country had seen in previous recessions. The last economic recession prior to that was caused by a collapse in global commodity prices and during that pre-industrialisation period before factories mushroomed throughout the major centres of the country, unemployment soared. Unemployment was not a major issue in 1997/98 like it was in the prior recession but the crunch on company earnings meant wage cuts and employment freezes.

With the drop in crude oil and now with the resurgence of the US economy, the flight of money from the capital market has began.

Deja vu?

Most would argue that no two shocks or crisis are the same. There is always a trigger that is different from before. From the Asian financial crisis, the world has seen the collapse of the dotcom boom which crushed demand for IT products and services. Then there was the severe acute respiratory syndrome (SARS) crisis and the global financial crisis in 2008/09. There were periods of intermittent volatility in between those periods but there was nothing in Malaysia to suggest trouble ahead.

Shades of 1998 though have emerged in this latest wave of turmoil but the situation now is not the same as it was back then.

“We don’t see a crisis brewing in emerging Asia. But that is not to say there aren’t risks. We believe those risks are going to be mitigated and managed,” says World Bank country director for South-East Asia, Ulrich Zachau.

The fall in crude oil prices, which has been the trigger for Malaysia, has sent the currencies of oil-producing countries lower, affecting their revenues and budgets. In South-East Asia, pressure has been telling on the ringgit and the Indonesian rupiah.

Reminiscent of the gloom and doom of 1997/98, the Indonesian rupiah tanked against the dollar to levels last seen during that period.

Intervention by the Indonesian central bank addressed the decline, but the situation is also different today then it was back nearly two decades ago.

“Bank Negara is still mopping up liquidity today,” says another fund manager who started work in Malaysia in the early 1990s.

Although liquidity is plentiful in Malaysia, money has been coming out of the stock market. Foreign selling has been pronounced this year and the wave of selling has seen more money flow out of the stock market this year than what was put in to buy stocks last year.

Equities is just an aspect of it as the bigger worry is in Government bonds where foreigners hold more than 40% of issued government debt.

“The fear is capital flight and people are looking to lock in their gains,” says the fund manager.

“The worry will start when people get irrational.”

Times are different

While the selling that is taking place in the capital markets is a concern, Malaysia of today is vastly different than it was during the 1997/98 period.

For one, corporates in Malaysia are not as leveraged as they were back then. Corporate debt-to-gross domestic product (GDP) ratio is below 100% but it was above 130% in 1998. Furthermore, corporate profits are still steady although general expectations have been missed in the last earnings season.

Secondly, fund managers point out that the banking system is in far better health today, better capitalised and seeing the average loan-to-deposit ratio below 100%. That loan-to-deposit ratio was much higher than 100% during the 1997/98 period and and as loans turned bad, the banks got into trouble.

“Fundamentally, we are much stronger now. That was not the case back then,” says a corporate lawyer.

“The worry though is on perception and denials that there is no trouble.”

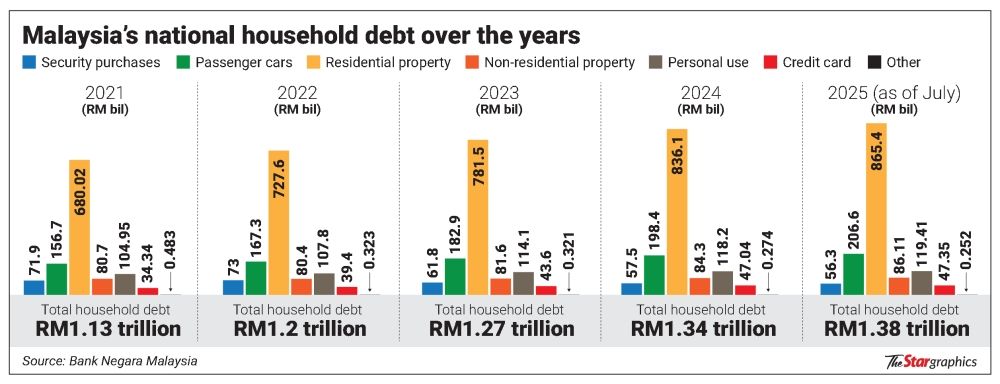

The one big worry, though, is household debt. That ratio to GDP is crawling towards the 90% level while it was not even an issue back in 1997/98.

Sensitivity analysis by Bank Negara which looks at several adverse scenarios, such as a 40% decline in the stock market and bad loans from corporates and households shooting up, indicate that the banking system can withstand a major shock.

“The scenario-based solvency stress test for the period 2014 to 2016 incorporated simultaneous shocks on revenue, funding, credit, market and insurance risk exposures, taking into account a series of tail-risk events and downside risks to the global economic outlook.

“The simulated spillovers on the domestic economy were used to assess the compounding year-on-year impact on income and operating expenses, balance sheet growth and capitalisation of financial institutions, disregarding any loss mitigation responses by financial institutions or policy intervention by the authorities,” says Bank Negara in its Financial Stability and Payment Systems Report.

“Even under the adverse scenario, the post-shock aggregate TCR (total capital ratio) and CET1 (common equity tier 1) capital ratio of the banking system were sustained at 10% and 7% respectively, remaining above the minimum regulatory requirement under Basel III based on the phase-in arrangements which are consistent with the global timeline,” it says in the report.

Government finances and the current account

The line in the sand for Government finances seems to be at the US$60 per barrel level for crude oil prices. A number of economists feel the Government will miss its fiscal target of a 3% deficit next year should the price of crude oil drop below that level.

With oil and gas being such a big component of the economy than what it was in 1997/98, the drop in the price of crude oil could also spell trouble for the current account and cause a deficit in the trade account.

Those concerns have been highlighted by local economists and yesterday, Fitch Ratings echoed that worry.

“Cheaper oil is positive for the terms of trade of most major Asian economies. But for Malaysia, which is the only net oil exporter among Fitch-rated emerging Asian sovereigns, the fall increases the risk of missing fiscal targets.

“The risk of a twin fiscal and external deficit, which could spark greater volatility in capital flows, has increased. Malaysia’s deep local capital markets have a downside in that they leave the country exposed to shifts in investor risk appetite. Malaysia’s foreign reserves dropped 6.8% between end-2013 and end-November 2014, the biggest decline in Fitch-rated emerging Asia,” it says in a statement yesterday.

Despite the softness in the property market and corporates getting worried about their profits, the general feeling is that Malaysia will not see a repeat of 1997/98. The drop in the ringgit and revenue for crude oil will mean a period of adjustment but the cheaper ringgit will make exports more competitive.

The difference between then and now

The ringgit vs the dollar ...

The ringgit’s steep decline against the dollar has made it one of the

worst performing currencies of late. That decline, although steep

and having caught the attention of the central bank, is more down to the

link with the decline in crude oil than structural issues to be

worried about.

Capital ratios of banks ...

Banks today are far better capitalised then they were during the 1997/98

crisis, which forced the local banking industry to consolidate for

their own good. Stress tests by the central bank suggests then

even under adverse conditions, banks in Malaysia wil be able to

withstand the shock associated with it.

Loans-to-deposit ratio ...

The ratio of loans against the deposit of banks have been rising but it

is no where at the level before the Asian financial crisis in 1997/98.

Banks too are aware of making sure it does not cross 100% and the

development of the bond market means leverage risk has been diversified

from the banking sector.

Businesses not as leveraged ...

One of the reasons corporate Malaysia was in trouble in 1997/98 was down

to its leverage, or debt levels. Today. corporates are not as geared as

they were back then and although that level is rising, their financial

position and better cash balances and generation means they are able to

better withstand a shock to the economy.

Household debt to GDP ...

This is the biggest worry. As households are leveraged despite the

financial assets backing it, that means any economic weakness or shock

will affect the ability to service loans taken to buy those assets. As

consumer demand has been a big driver to the economy, any changes the

affects the ability of consumers to continue spending will impact on

economy growth and have an impact on non-performing loans in the banking

sector.

Dropping current account surplus ...

The decline in the current account surplus means that the domestic

economy has been growing strongly. There were concerns earlier and the

prioritisation of projects was able to smoothen imports to ensure

a positive balance of trade. The drop in crude oil prices could mean a

deficit in the current account in the first quarter of next year but the

weaker ringgit should translate to better exports and a better current

account balance thereafter.

By JAGDEV SINGH SIDHU Starbizweek

Related stories:

Related posts:

Oil & Gas lead to wealth crunch, Malaysian Ringgit beaten and dropped!

Related posts:

Oil & Gas lead to wealth crunch, Malaysian Ringgit beaten and dropped!

Oil enters a new era of low prices: Opec vs US shale, impacts, perils as Petronas cuts capex

Oil enters a new era of low prices: Opec vs US shale, impacts, perils as Petronas cuts capex

Oil Enters New Era as OPEC Faces Off

Against Shale; Who Blinks as Price Slides Toward $70? How Oil's

Price Plunge Impacts Wall S...

Timing of latest fuel subsidy cut a

surprise PETALING JAYA - The latest round of fuel subsidy

rationalisation came as a surprise ...

Our cars are costing us our homes!

Our cars are costing us our homes!