Draw Lessons From China To Leapfrog Mala ysia's Economy | Bizworld, 6 September 2023;

China's Huawei Defeats US Sanctions with Breakthrough in Chips

The Ministry of Investment, Trade and Industry (MITI) said that despite the slowdown in China’s economy affected by the property development and construction sectors, the country’s manufacturing and technology sectors are still doing very well.

"Leapfrogging means that you do not continue to produce at the same level. You must try to upgrade technologically to produce by adopting automation as well as making digital arrangement.

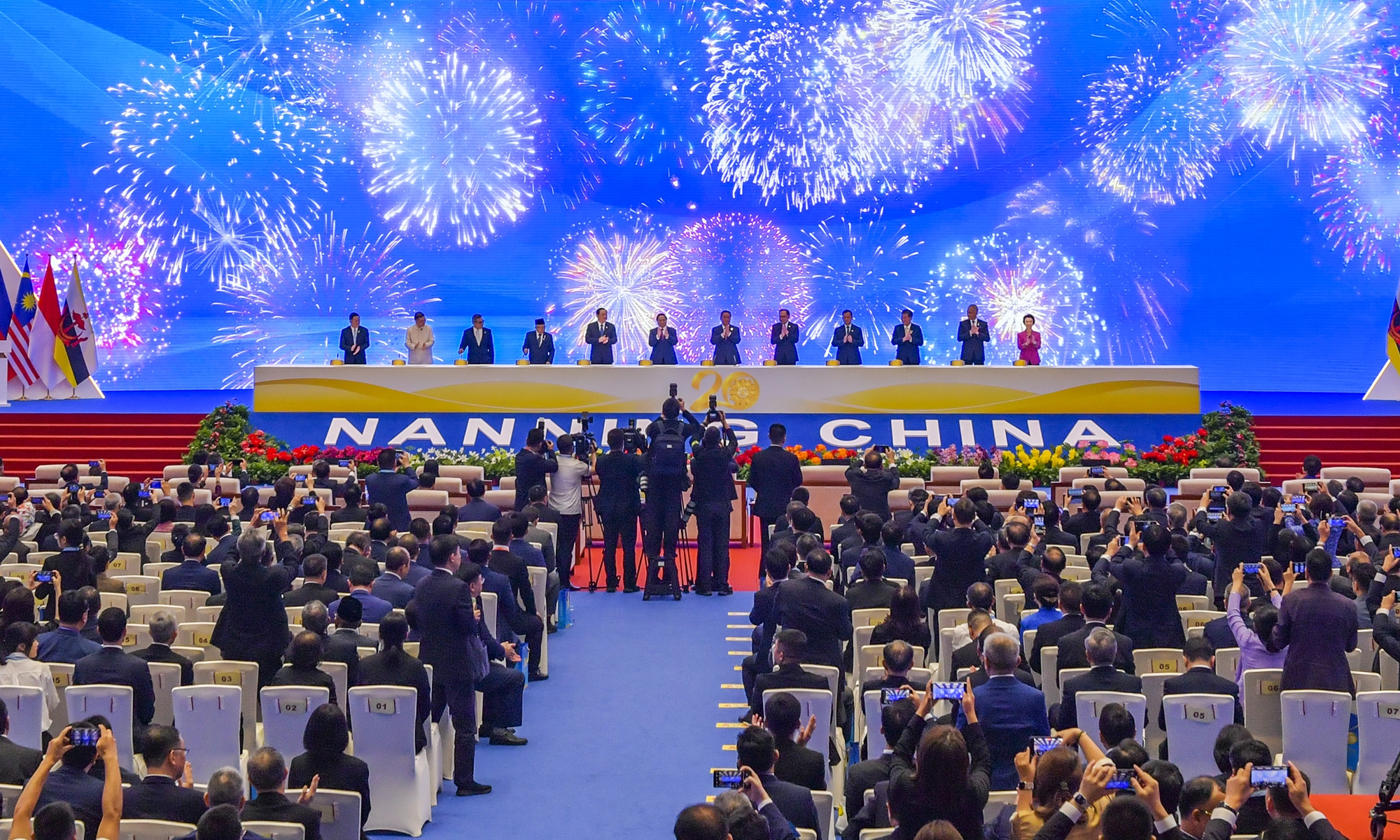

"We must do things differently and win the game at a higher level with higher wages, higher productivity and higher growth,” Deputy Investment, Trade and Industry Minister Liew Chin Tong told reporters after launching the 5th Malaysia-China business to business (B2B) business matching in conjunction with the 20th China-Asean Expo (CAEXPO) 2023 here today.

He noted that the Madani Economy framework and the New Industrial Master Plan launched recently by Prime Minister Datuk Seri Anwar Ibrahim are both also aimed to leapfrog Malaysia’s economy.

On CAEXPO 2023, he shared that Anwar will be attending the exposition on Sept 17 in Nanning, China, and the visit sought to strengthen ties between the two countries as well as to build on and be prepared for the 50th anniversary of Malaysia-China relationship.

Meanwhile, Malaysia External Trade Development Corporation (MATRADE) senior director of export promotion and market access division, Amran Yem, in his speech, said Malaysia and China's friendly relationship is not only preserving but also propelling the trajectory of strong and dynamic economic links between the two countries.

"Currently, the bilateral trade relationship between Malaysia and China has been progressing well with total trade between our two countries in 2022 at almost RM500 billion, an increase of 15.6 per cent when compared to 2021.

"Malaysia’s exports surpassed the RM200 billion mark for the first time, expanding by 9.4 per cent to RM211 billion and were the highest value ever recorded. Similarly, imports recorded almost RM300 billion with 20.7 per cent growth,” he said.

After experiencing three years of border closure, this year marks the 20th anniversary of the CAEXPO and so does Malaysia’s participation.

Since 2004, Malaysia’s participation in CAEXPO had successfully assisted more than 2,000 companies with accumulated business dealing amounting to over US$1 billion, he noted.

Many Malaysian brands had made their presence and even strengthened their footprints in the Chinese market through their participation in CAEXPO and these outcomes signified the exposition as an important platform for Malaysian companies to make further inroads into the huge Chinese market and this relevance continues, he pointed out.

For this year’s CAEXPO, he said, MATRADE is coordinating a total of 107 Malaysian enterprises that will be showcasing their diverse range of high value products and services, including healthcare and wellness, pharmaceuticals, cosmetics and toiletries, palm oil as biomass, functional food and beverages as well as the services sectors including accounting, interior design and education.

"As for the B2B meetings this year, it was organised using the hybrid mode with the virtual business meeting session beginning today until Sept 8, 2023.

"The physical business meetings will be held from Sept 16 to 19 as a follow up. It is expected that more than 200 business meetings will be held for both physical and virtual sessions,” he added. - Bernama

China: 'Fundamentals' the same despite slowdown | The Star

Chinese Premier Li Qiang hailed the close partnership between China and ASEAN at a key expo event on Sunday, saying ...

- Chinese economy to witness robust consumption recovery in upcoming National Day holidays

From an airplane to a high-speed railway train, from Beijing's Palace Museum to Shanghai's Bund, from various shopping malls to ...

Related posts:

China slams US’ unreasonable crackdown on Chinese tech firms, as Washington reportedly probes Huawei chips

NIMP 2030 Sets Breakthrough Agenda, poised to attract more investments

- INDUSTRIAL MASTER PLAN PM Launches Malaysia’s 4th Industrial Master Plan IT is a pivotal moment for Malaysia’s industrial development. Ma...

NIMP 2030 is the ‘key to the future’

PM: Reshaping of skills, jobs, wages will expand middle class KUALA LUMPUR: High-value job opportunities are among the focuses of t...