KUALA LUMPUR: It is not always that emerging economies get favourable remarks from hard-boiled foreign media practitioners but Malaysia is getting more laudatory remarks from foreign journalists these days.

Take Jeremy Grant's article on Kuala Lumpur's soon-to-be-developed new financial centre, the Tun Razak Exchange, and the state of the Malaysian economy in the Financial Times Friday, for example.

He wrote: “With much of the world economy experiencing anaemic growth at best, it is hard to believe that any country would contemplate a project on this scale.

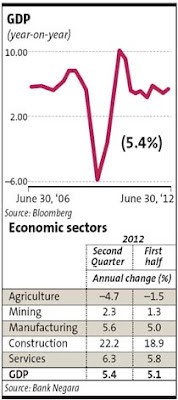

“Yet Malaysia's economy is enjoying a gravity-defying boom that is confounding sceptics. Second-quarter gross domestic product figures out this week showed the economy grew by 5.4%, way above consensus expectations of 4.6%, and the 4.9% recorded - after an upward revision - for the previous quarter.”

Grant attributed this development to big-ticket government spending, lending to business by well-capitalised banks, and robust consumer demand, fuelled by pay rises for civil servants and cash handouts that have even seen taxi drivers receive vouchers for free replacement tyres.

“Malaysia's stock market has been among the best performers in the world, buoyed by big flotations including Felda, a state-controlled palm oil producer, which was the second-largest initial public offering after Facebook when it raised over USD2bil last month. Bankers are cashing in with a parade of further IPOs expected within months,” he added.

“Much of the impetus behind the growth comes from the “economic transformation programme” initiated by Prime Minister Datuk Seri Najib Tun Razak when he came to power in 2009.

This involves dozens of government-backed projects designed to boost per capita income to USD15,500 by 2020, from USD9,600 last year and lift Malaysia out of its “middle-income trap”, Grant wrote.

The Financial Times also quoted Christian de Guzman, an analyst at Moody's, a rating agency, who admitted he was sceptical about the programme's ability to spur private sector development when it was launched. De Guzman is more convinced now, adding that “The proof of the pudding is in the eating but so far they are on track. In aggregate there are just so many things going on [in the economy].”

Grant wrote that “Not only has Malaysia experienced strong domestic demand offsetting its vulnerability to weakening demand for its exports - much of them electronics destined for Europe; it has also benefited from deeper ties with economies in Asia.

Moody's says that in 2006 the United States was Malaysia's largest trading partner, absorbing 18.8 per cent of its exports, while Asia Pacific accounted for 60 per cent. By last year the US share had dwindled to 8.3 per cent while Asia Pacific jumped to 69 per cent.

Malaysia's healthy economy - and the resulting “feel good” factor - stands in contrast to growing anxiety among Malaysia's neighbours in south-east Asia as the global downturn has tarnished their economies.

Analysts point out one nagging concern for Malaysia: rising household debt, caused by rapid growth in credit card usage.

As the transformation programme's projects take root, Grant wrote that Bank Negara Malaysia is forecasting full-year growth at the upper end of its 4-5 per cent.

Amidst this scenario, the Financial Times also quoted Rahul Bajoria, an anaylst at Barclays, as saying that: “We expect momentum to remain underpinned as the project-based nature of these investments means that it is unlikely to be halted abruptly.” - Bernama

Related posts:

Malaysia's Days in the Sun - WSJ

Malaysia's growth forecasts raised after the actual 5.4% in Q2, 2012

Total

Total